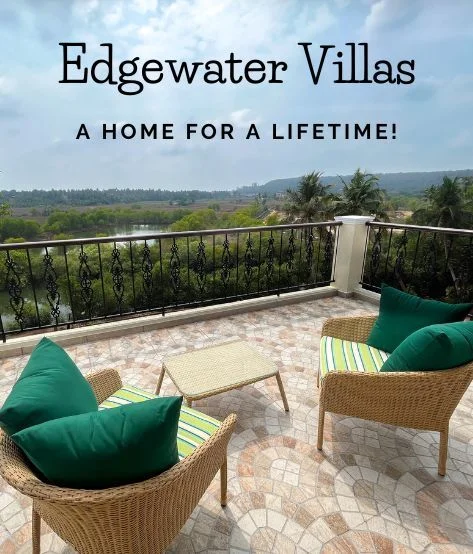

For many buyers, the decision to invest in Goa begins with a dream—a serene villa by the fields, a balcony that opens to the sea, a community where every detail is in place. But between that dream and reality lies one recurring question: “What is my real cost after GST?”

It’s a fair concern. Taxes can often feel like hidden hurdles. At Acron, we’ve seen families pause, calculate, and even postpone purchases simply because they weren’t sure how GST applied. That’s why, when you’re evaluating the best villas in North Goa, understanding the GST impact is not just about numbers—it’s about peace of mind.

When GST Applies—and When It Doesn’t

Here’s the simplest way to remember it:- Under-construction homes: GST applies—5% for non-affordable and 1% for affordable housing, without ITC.

- Ready-to-move/OC-issued homes: No GST. Only state stamp duty and registration apply.

- Rental investors target properties that meet premium guest expectations, because only those attract steady occupancy and strong reviews.

- Dwelling investors look for the same standards in everyday life — gated security, proper infrastructure, and well-maintained communities.

This distinction makes a huge difference. We recall a family from Pune who had shortlisted two options—a partly under-construction luxury villa in North Goa and a ready possession villa. The ready home saved them nearly 5% GST upfront. For them, that meant the budget stretched to cover interior design and furniture, not extra tax.

Proof in Everyday Choices

The GST difference isn’t just theory—it shapes real buyer behaviour. Over the last year, we’ve noticed many NRIs favouring ready villas for precisely this reason. They value the certainty: no GST, possession without delay, and only stamp duty and registration to consider.

On the other hand, younger couples often lean towards under-construction options. The GST applies, yes, but phased payments and early booking allow them to choose prime locations and layouts. For instance, one couple booked a 3-bedroom villa in North Goa early in construction and secured a garden-facing unit that might not have been available at possession stage.

- - For rental investors, it means steadier yields.

- - For dwelling buyers, it means their home retains long-term value and grows with the market.

Don’t Forget State Levies

While GST headlines dominate conversations, Goa’s stamp duty (3.5%–6%) and registration fees (1%–3.5%) matter just as much. These are payable regardless of GST and vary by location and property value.

When a buyer recently closed on a 4-bedroom villa in North Goa, our team helped them map every charge—from stamp duty based on Bardez circle rates to exact registration costs. That clarity gave them the confidence to move forward without worrying about surprise expenses later.

What Happens After Possession

The GST story doesn’t end at purchase. Maintenance and rentals carry their own rules:

- Maintenance: GST at 18% applies only if monthly charges exceed ₹7,500 and the community turnover is over ₹20 lakh. For premium gated clusters, this is common, so it’s important to budget accordingly. Many owners of the best villas in North Goa prefer the transparency of having this explained upfront.

- Rentals: Renting to an individual is GST-free. Leasing to a GST-registered company (say, for staff accommodation) falls under RCM, meaning the tenant handles GST compliance. For investors, this can actually simplify things.